Magpie Links #30: 2025/06/19

Charts on finance, debt, and tariffs, articles about lying and birth policy and Russia's economy, photo of an old bridge.

Common Grackle by skip2molou via Flickr.

Russia’s economy is starting to show cracks as fiscal stimulus benefits of wartime spending diminish.

Putin’s obsession with not losing in Ukraine has damaged the Russian economy. The sugar high of military spending is over, and growth has dwindled from 5 percent at the war’s start to zero. An overheated labor market has inflation running at around 10 percent. Falling energy prices due to Trump’s burgeoning trade wars and China’s slumping economy could eviscerate Russia’s state budget, which relies heavily on the sale of gas and oil. Russians, who are far from going hungry, have to be asking themselves about the wisdom of their government at the moment, about higher prices and a grim economic horizon for the sake of a stalemated, counterproductive, and unnecessary war. The only thing more dangerous to a political leader than a war of choice is a war of choice that goes badly.

Source: Foreign Policy (Michael Kimmage) (2025/05/19) Russia Has Started Losing the War in Ukraine

Israel-Iran conflict could lend Russia a lifeline for its economy. But oil prices are still very low compared to a three year peak in early 2022, important as energy contributes as much as half of federal receipts.

Source: FT

Long term yields are rising and not just in the US.

As I discussed in yesterday’s post, it’s the very long end of the yield curve where risk premia are most important. That’s why I look at the 30-year government bond yield in the US (black), Germany (red), Japan (blue) and the UK (orange). Long-term yields in the US are up, but the truth is that what’s going on in the US is modest compared to the UK or Japan, where - in both cases - the 30-year yield is now at its highest level going back all the way to 2000. The global debt binge during and after COVID is now exacting a price, with global yields rising sharply. Poor fiscal policy is a global problem, not just a US problem.

Source:

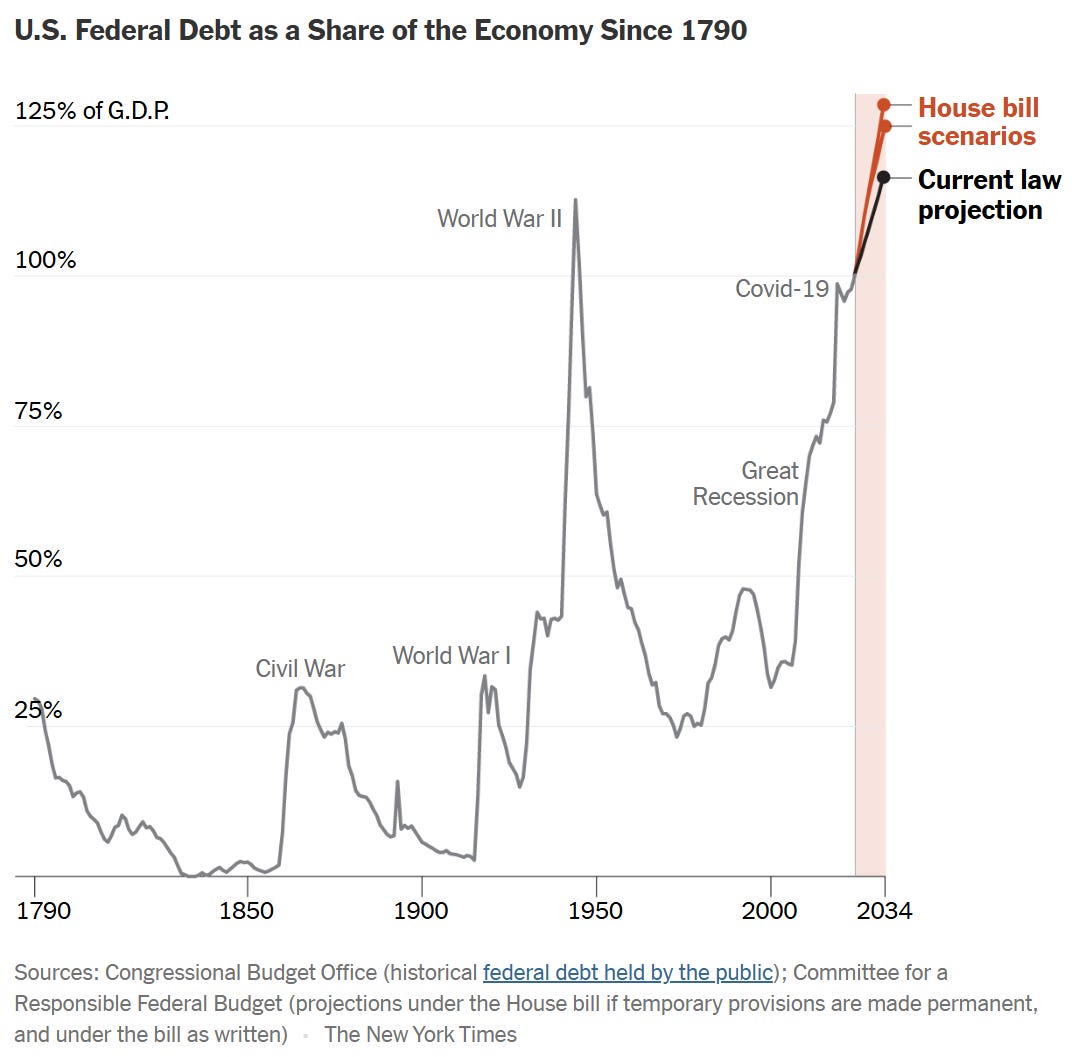

US debt is projected to be at its highest level with the new budget since 1790.

Source: NYTimes (Alicia Parlapiano, Margot Sanger-Katz) (2025/05/20)

Advanced economies are adopting industrial policy on a wide scale, often by offering grants and cheap loans to companies – an option that emerging market and developing economies do not have.

More than 2500 industrial policies were recorded in 2023—more than half of them from the US, Europe, and China. Advanced economies and developing countries alike are embracing more interventionist policies and engaging in policy experimentation.

Source: Phenomenal World (Ilias Alami, Tom Chodor, Jack Taggart) (2025/06/14)

Imports of key goods including pharmaceuticals to the US spiked amid tariff rhetoric with the EU. Across the board, tariffs have resulted in a drop in imports after an initial spike, while US exports are also down amid retaliatory tariffs and rising trade uncertainty.

The second major contributor to recent historic shifts in the trade deficit has been pharmaceuticals, where imports peaked at 142% above their 2024 levels before dropping. Drug imports have been mentioned as a key tariff target for months, and while they have so far remained exempt from almost all of Trump’s tariffs, pharmaceutical companies are not taking any chances and stocking up as much inventory as possible. The vast majority of that import surge has come from the European Union, home of research and manufacturing hubs that have long been America’s number one foreign source of medicine—and they’ve been particularly concentrated in Ireland, where many drug multinationals manufacture for tax avoidance purposes.

Source:

Tariffs may not induce innovation like its proponents claim.

Coelli, Moxnes, and Ulltveit-Moe have a 2022 paper that exploits the “Great Liberalization” of the 1990s across 65 countries and finds that trade policy reforms explained approximately 7% of global knowledge creation increases during that period. Crucially, both improved market access and import liberalization contributed positively to innovation.

What makes their approach compelling is how they measure trade liberalization. Rather than relying on a single metric, they use multiple indicators, including tariff reductions, non-tariff barrier removals, and capital account liberalization. This comprehensive approach helps capture the multifaceted nature of trade reform that characterized the 1990s.

The results strongly support the pro-innovation effects of trade openness. When they decompose the channels, they find that both export market access and access to more imports increase innovation. Export opportunities increase innovation by expanding the potential market for new technologies, raising the returns to R&D investment. Import liberalization, meanwhile, spurs innovation through competitive pressure and access to foreign knowledge and intermediate inputs.

Adam Posen of PIIE on tariffs as a tax.

Foreign tax. Hard to see how this low-visibility addition to the proposed US budget would help with encouraging investment in growing US manufacturing needs. I would like to see any studies on how a potential 899 tax would affect capital flows; I’m skeptical that revenues from the tax would outweigh the damage of potential capital outflows, but I haven’t seen any numbers so far on the pros and cons of the proposed policy.

For foreign investors, section 899 would increase taxes on dividends and interest on US stocks and some corporate bonds by 5 percentage points every year for four years. It would also impose taxes on the American portfolio holdings of sovereign wealth funds, which are currently exempt. … “Section 899 is legally ambiguous regarding a potential tax on treasuries,” said Lewis Alexander, chief economic strategist at hedge fund Rokos Capital Management. “Taxing treasuries could be counter-productive as any potential revenues likely would be outweighed by a resulting increase in borrowing costs [as investors sell the debt.]” … “Our foreign clients are calling us panicked about this,” said a managing director at a large US bond fund. “It’s not totally clear whether Treasury holdings will be taxed, but our foreign investors are currently assuming they will be.”

Source: FT (Kate Duguid, Harriet Clarfelt, George Steer, Alex Rogers) (2025/05/29)

German banks have an unusual number of elected officials in senior positions. Close ties between local politics and banks in Germany potentially undermine the governance of German banks and encourage low performance lending for political gains.

Germany's 359 local savings banks control €2.5 trillion in assets—making them one of Europe's three largest banking groups.1 Unlike normal banks, politicians openly control these institutions, since county governments appoint board members and committee chairs.

Véron and Markgraf (2018) show the extent of the entanglement between local savings banks and local politics: 82 percent of Sparkassen board chairs are elected officials. Most county executives chair their local Sparkasse. For North Rhine-Westphalia politicians who chair boards, Sparkassen fees average 12 percent of their total income.

This political control produces predictable distortions. Sparkassen increase lending by 1.5 percent before county elections—about €30 million per bank (Englmaier and Stowasser, 2017). There is no effect around state elections. Only county elections—where Sparkassen chairmen face voters—trigger the lending surge. These politically timed loans perform poorly, with profitability dropping immediately and defaults spiking three years later.

Source:

The share of student loan balances that are delinquent jumped to 8% from 1% in the first quarter of 2025. Among borrowers with payments due, 23.7% are behind on payments (vs. 22.1% prior to the pandemic).

Americans have warmer feelings towards labor unions and cooler feelings toward big business than at any time in 6 decades of data.

Source:

Why even use active fund managers with these success rates?

Source: Apollo Academy (Torsten Slok) (2025/05/29)

How much is 33.9bn?

NSO group and surveillance. The world’s most notorious spyware company has doubled down on selling its surveillance tech to authoritarian governments. But more worrying is that they have allegedly began losing control of their IP as an employee reportedly tried to sell NSO code online and a Russian government hacking operation showed traces of NSO code use.

Source:

DC’s transportation time tax - it takes more than twice as long to travel somewhere in DC by public transit than by car.

Our analysis shows that transit trips in the District take on average over 2.5 times longer than driving the same route. In real terms, that’s an average transportation time tax of over 31 minutes per trip. The most extreme cases show transit trips taking up to eight times longer than driving the equivalent route, with the 90th percentile multiple at 3.8×.

Source: Greater Greater Washington (Karthik Balasubramanian, Kai Hall) (2025/05/20)

The gulf between liberal and conservative voters by gender in South Korea beggars belief.

Japan continues to get birth rate policy wrong. Japan is proposing a policy to make childbirth healthcare free as part of its policy suite to incentivize more births. Enacting small subsidies like this ignore the main reasons why people in Japan are not having children – gender inequality, low pay, and high care costs relative to wages. Until there is a concerted effort to address these issues, these policies will achieve limited gains.

Kazuo Yamaguchi, a professor [of] sociology in the University of Chicago, told Newsweek: "It is not the costs of childbearing that matter. The birth rate is low primarily because the marriage rate is low. Many women decide not to marry because they cannot believe that marriage will make them happy. Gender inequality is very high in Japan in both labor market opportunities and in the household division of labor. More than 50 percent of women are irregularly employed with very low annual income and the large majority of them are married women with children."

Yamaguchi added: "Among women aged 30 to 40, the percentage of those with a child is 45 percent among regularly employed and about 70 percent among irregularly employed. It means once married, many of them have to leave regular employment because the Japanese employment system is discriminatory against women with a child for regular employment as it requires long hours of work, and a strong persistence of unequal household division of labor exists, even when women are employed. Achieving a gender-equal society is the only solution to Japan's declining fertility rate."

Source: Newsweek (Jasmine Laws) (2025/05/16)

Lying. A fascinating article about a popular game of deception in Iraq.

When you hear the game described, mheibes doesn’t sound difficult. It sounds impossible. Assembled on the court in front of al-Sheikhli were his opponents: 45 men from the city of Najaf, arranged in three neat rows. One of these players held a silver ring. It was al-Sheikhli’s job to determine which one—and in which fist he held the ring—judging only by his facial cues and other tells.

Source: The Atlantic (Jason Anthony, Cannaday Chapman) (202506/14)

Ebisubashi bridge, 1890s.

Source: Old Photos Japan (Kimbei Kusakabe)